Sigortada Güvenin Adresi

Doğru Ürün. İyi Fiyat. 7/24 Hizmet.

Poliçemi neden Sigortam.net’ten almalıyım?

Doğru Ürün

Doğru Ürün Yenilenen yapay zekâmızla, onlarca sigorta teklifi arasından ucuzunu, sana uygununu ve kapsamlısını buluyoruz. Net teminatlar ve net fiyatlarla kararın hep net olsun.

İyi Fiyat

İyi Fiyat Önceliğimiz her zaman sensin. Çalıştığımız tüm şirketlerde bütçeni düşünerek “en iyi fiyat garantisi” sunuyoruz.

7/24 Hizmet

7/24 Hizmet 24 yıllık tecrübemiz ve uzman sigorta danışmanlarımızla 7/24 her ihtiyacında yanındayız. Üstelik hasar anında saniyeler içinde bize ulaşabilirsin.

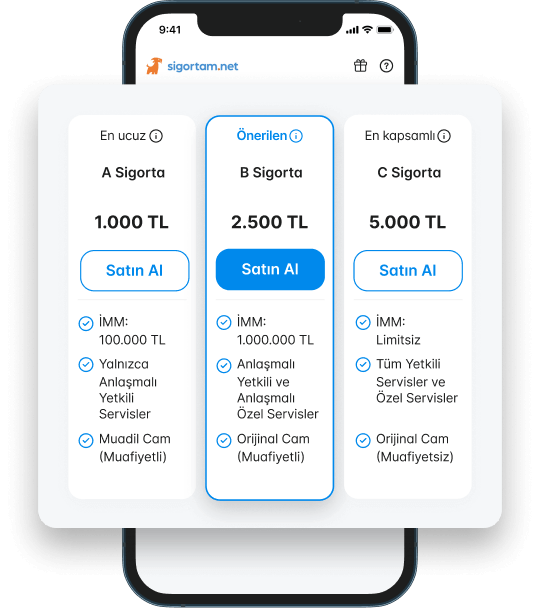

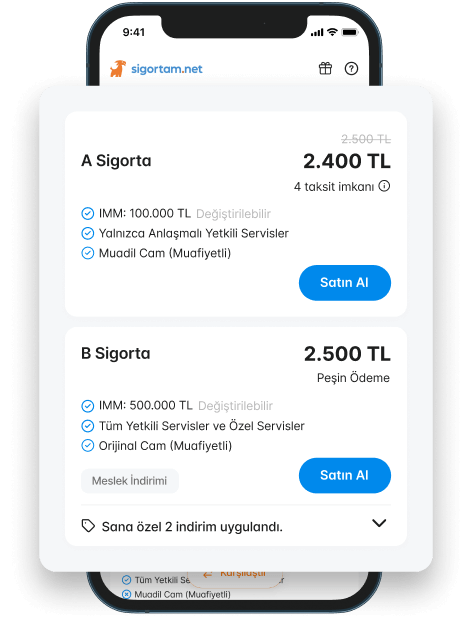

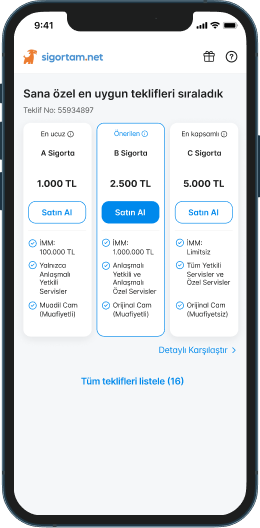

Hangi ürün bana en uygun diye düşünme, biz senin için en net teklifleri sıraladık bile!

Tüm teminatları tek tek inceledik, ihtiyaçlarına en uygun olan teminatları belirledik. Sana özel kapsamlı ve fiyatı uygun ürün önerileri hazırladık.

Sadece 2 dakikada tüm teklifleri kolayca karşılaştır.

20+ sigorta şirketinden teklifleri tek platformda karşılaştır, internete özel indirimlerle uygun fiyata sigortan anında başlasın.

Görseldeki fiyatlar temsilidir. Aracına özel fiyatları tekliflerde görebilirsin.

Görseldeki fiyatlar temsilidir. Aracına özel fiyatları tekliflerde görebilirsin. Sigortam.net'te sana özel neler var?

- İndirimler & Kampanyalar

- Reklam Filmleri

- Öne Çıkanlar

Sigortam.net Hakkında En Merak Edilen 5 Soru

Sigortam.net Türkiye’nin ilk ve lider online sigorta brokeridir. Broker olarak farkımız, öncelikli olarak müşterilerimizi temsil etmemiz ve onların menfaatleri doğrultusunda hareket etmemizdir. Bu misyonla her zaman müşterilerimizin tarafındayız ve 20+ sigorta şirketi teklifini tek bir sayfada görmelerini, hem teminatları hem de fiyatları objektif olarak karşılaştırmalarını sağlıyoruz. Böylece müşterilerimiz ihtiyaçlarına en uygun sigortayı kolayca belirliyor ve online olarak satın alabiliyor. Ayrıca satış sonrası herhangi bir ihtiyacınızda 24 yıllık tecrübeli ekibimiz 7/24 desteğe hazır.

Sigortada Güvenin Adresi

Doğru Ürün. İyi Fiyat. 7/24 Hizmet.

~9 Milyon Mutlu Müşteri, 50+ Milyon Poliçe Teklifi